Trade Protection – What Impact on Jobs and Wages?

Nicolas Benoit and Patrick Lenain | 23 December 2022

Trade, Blog | Tags: Protectionism, Trade Liberalization, Unemployment, Wages

Trade protection is making a comeback. A new world order is emerging, with higher trade tariffs and more anti-dumping duties. Among various rationales, import protection has been advocated on the grounds that it is needed to protect jobs and support workers’ wages. New econometric estimates indicate that import tariffs imposed by the United States on imports from China have achieved the desired objective of increasing employment and raising wages in the targeted industries. Before concluding that trade protection is beneficial, multiple downside risks need to be taken into consideration.

U.S.-China Trade Dispute

The return of trade protection is best illustrated by the U.S.-China trade altercation. In mid-2018, arguing that surging imports had destroyed many jobs and depressed wages, the Trump Administration imposed tariffs ranging from 10% to 50% on goods imported from China. More than US$ 250 billion of goods were covered by higher tariffs, including washing machines, solar panels, aluminum, and steel. In retaliation, China imposed import restrictions on U.S. products ranging from food items, autos, and metal products.

The Biden Administration has retained these import tariffs. U.S.-China bilateral trade is now subject to tariffs averaging 20% on both sides. Although the two countries keep an open dialogue, trade relations are unlikely to normalize anytime soon.

Trade and Jobs

Economists have long argued that trade liberalization brings benefits at the aggregate level thanks to the reallocation of resources from sectors of comparative disadvantage to sectors of comparative advantage, and from less productive to more productive firms within sectors. The integration of China in global trade is a case in point: China’s accession to the World Trade Organisation (WTO) in 2001 has brought large benefits at the aggregate level to both countries.

These aggregate gains notwithstanding, the reallocation of resources set off by trade liberalization inflicts pain to workers, firms, industries, and regions that do not benefit from comparative advantage. This is particularly so when frictions impede the mobility of workers. For instance, government regulations such as occupational licensing throw sand in the wheels of the labour market, as they prevent smooth job mobility across state borders. This can generate pockets of local unemployment and put some cities on a path of economic decline, while other cities benefitting from comparative advantage enjoy a boom.

A new strand of research has shed light on what happens to those who lose from trade liberalization, taking the case of China’s WTO accession. Researchers faced the methodological difficulty of splitting up changes due to import competition from other drivers. This is particularly difficult for the first decade of the 2000s, when a series of shocks dealt a blow to manufacturing: trade liberalization, industrial automation, fast robotization, and the global financial crisis.

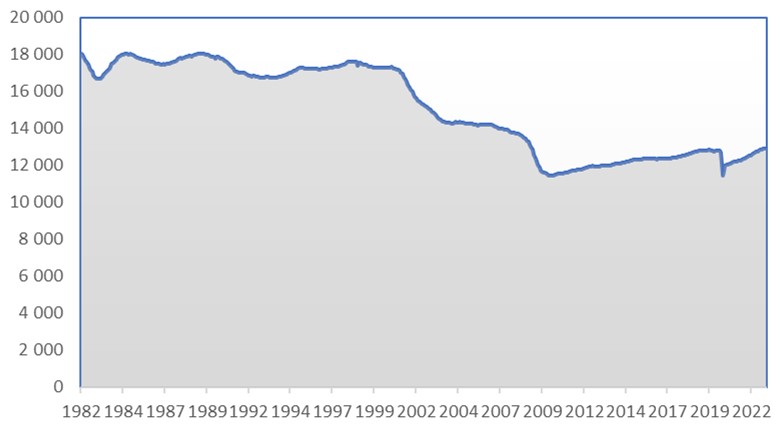

Using a new empirical approach, David Autor and co-authors estimated that out of 6 million jobs lost in manufacturing during the period 1999-2011, a significant share (2 million) was the result of competition from China. To obtain this estimate, they used granular cross-industry data at the level of commuting zones and investigated the impact of variation in import competition stemming from China’s rapidly rising productivity and falling barriers to trade.

U.S. Employment in Manufacturing (in thousands)

Source: U.S. Department of Labor

This quantitative estimate of the “China import shock” has been debated, and further studies have suggested a lower impact. Nonetheless, it is widely accepted that China’s growing imports created difficulties in localities that were trade-exposed, specialized in labour-intensive manufacturing, and lacked a supply of college-educated workers. The local consequences have gone beyond jobs and earnings. Autor, Dorn and Hanson (2021) point to “lower marriage rates, increased single parenthood, a higher incidence of children living in poverty, and increased mortality from drug and alcohol abuse, especially among young males”. Moreover, these scarring effects are found to be persistent over time: various frictions hinder the type of smooth resource reallocation predicted in textbook models.

That trade displaces workers is nothing new. David Ricardo had already explained in the early 19th century that freer trade inevitably comes with winners and losers but, overall, gains exceed losses and nations benefit from trade. What is new is the geographic concentration and visibility of job losses. U.S. Midwest states (Michigan, Ohio, Wisconsin, and Pennsylvania) were directly exposed to import competition from China, due to their concentration of jobs in labour-intensive industries such as furniture, appliances, and light electronics. By contrast, states in coastal areas have benefitted from trade liberalization – with exports to China of electronics, technology, aviation, medicine, and financial services. This has impacted on the country’s social cohesion.

Do Import Restrictions Bring Back Jobs?

Does it follow, vice versa, that import protection will bring jobs back? New research by Benoit (2022) measures the impact of the four U.S. import tariff waves introduced by the Trump Administration targeting Chinese products between July 2018 and May 2019. Variations in import tariffs lead to changes in prices that affect employment and wages in the regions and industries facing import competition. The research relies on the methodology of Kovak (2013) to model U.S. states and commuting zones as specific-factors economies composed of multiple industries in such a way that, although all regions face the same set of price changes across industries, the effect of those price changes on a particular region’s labor market outcomes depends on the regional importance of each industry. Therefore, if regional employment is more concentrated in one industry, then the region’s outcomes will be heavily influenced by price changes in this particular industry.

The research finds that higher import tariffs have benefited wages and employment in regions where local industries have received greater import protection – such as the states of Michigan, Wyoming, West Virgina and North Dakota. Localities that benefitted from large increases in tariffs experienced faster wage growth (or slower wage decline) than those that benefitted from smaller tariff increases. For instance, a commuting zone benefitting from a 10-percentage point higher tariff increase is estimated to have experienced a 3.2 percentage point higher wage growth (or smaller wage decline) on average. Similar results are found for employment rates at the commuting zone level. These findings are robust to different sets of controls.

Average Import Tariff Increase by U.S. States (2017-2019)

Note: This figure shows the average import tariff increase by states during 2017-19. This is calculated as the sum of the log tariff increase in each industry of a given region, weighted by the industrial composition of workers from this region.

Source: Benoit, Nicolas (2022), Trade Protectionism and Regional Dynamics

However, this does not imply that the Trump and the Biden Administration trade restrictions are overall beneficial to American citizens. Several countervailing effects need to be kept in mind:

- China’s retaliatory measures are hurting U.S. export industries. Import tariffs introduced by China in retaliation to U.S. restrictions, and the subsequent escalation, have hurt U.S. industry and workers. Exporters of agricultural products and automobiles have been bearing the brunt of it. Nevertheless, estimates by Benoit (2022) suggest that the net impact of import protection on wages and employment remains positive, even taking account of retaliations.

- Higher cost for consumers. Research finds that the costs of the U.S. tariffs are almost entirely borne by U.S. firms and consumers. In many industries – though not all – Chinese exporters were able to pass through higher import tariffs to retail trade, making U.S. consumers bear the cost of tariffs. Ultimately, import tariffs are a tax on consumers. Estimates put the economic impact of the tariffs at US$52.6 billion based on 2021 import levels and country exemptions — one of the largest tax increases faced by American taxpayers in decades.

- Higher input costs paid by downstream industries. Trade restrictions such as import tariffs make imported inputs more expensive if, as noted, foreign exporters are able to pass them through to buyers. Imports are partially substituted by domestically produced inputs, which are also more expensive. Downstream industries therefore face higher production costs, which they pass to consumers if possible, or otherwise are followed by cuts in employment, wages and investment. Research focused on U.S. protection of steel and aluminum found such effects following the introduction of anti-dumping duties by the Bush Administration, and import tariffs by the Trump Administration.

The U.S.-China trade war has multifaceted impacts on the U.S. economy: it brings higher wages and more jobs to workers in selected commuting zones, while imposing costs on the rest. A thorough evaluation of these benefits and costs is critical before letting trade protection make a comeback.